Introduction

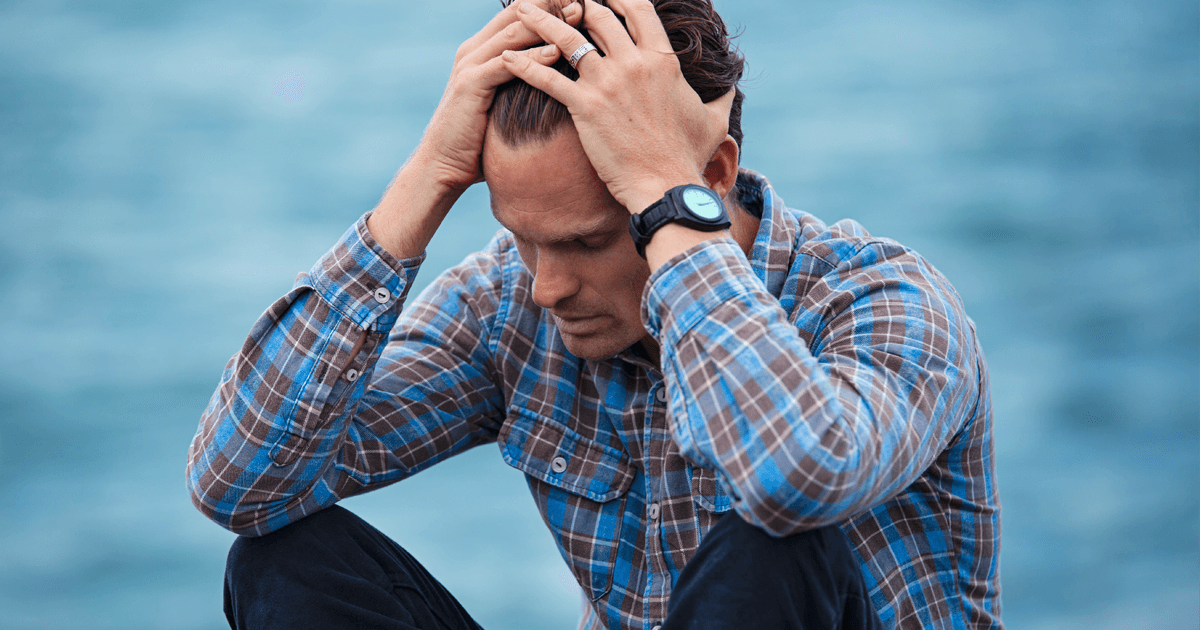

Debt and mental health issues are significant concerns for many Canadians, and there is a growing body of research that shows a strong link between the two. In this post, we’ll explore recent Canadian studies that have examined the connection between mental health and debt, and offer practical solutions to help those who are struggling.

The Impact of Debt on Mental Health

A Canadian study published in the International Journal of Mental Health and Addiction in 2019 found that Canadians with debt problems were more likely to experience suicidal thoughts.

This suggests that the stress of debt can have a significant impact on mental health, leading to symptoms like depression, anxiety, and even suicidal thoughts. The financial strain of debt can also lead to social isolation, relationship problems, and physical health issues, further exacerbating mental health concerns.

The Impact of Mental Health on Debt

Mental health issues can also have a significant impact on debt. A Canadian study published in the Journal of Consumer Affairs in 2017 found that individuals with mental health problems were more likely to use high-cost borrowing methods, like payday loans, and to struggle with managing their finances.

Another Canadian study published in the Journal of Nervous and Mental Disease in 2018 found that individuals with mental health problems were more likely to have difficulty accessing credit, and to have lower credit scores, which can lead to higher interest rates and further financial strain.

Strategies for Addressing Mental Health and Debt

For those struggling with mental health and debt, seeking professional support is crucial. The Canadian Mental Health Association and Credit Counselling Canada offer resources and support for those who are struggling with these issues.

Creating a budget and setting financial goals can also be helpful in managing debt-related stress. Practicing self-care, like exercising and getting enough sleep, can also help to alleviate some of the mental health issues associated with debt.

The Importance of Seeking Help

It’s essential to recognize the importance of seeking help for both mental health and debt issues. Addressing both issues together can be a key part of finding long-term solutions and improving overall quality of life. If you or someone you know is struggling with mental health or debt issues, don’t hesitate to reach out for support and resources.

Conclusion

Debt and mental health issues are serious concerns for many Canadians. By understanding the link between the two and taking practical steps to address them, individuals can find long-term solutions and improve their overall well-being. With resources and support available, there’s no need to struggle alone.

Additional Resources:

Suicide Prevention Hotline – 1.833.456.4566.

Calgary Counselling Centre – Open to all Albertans

Canadian Mental Health Association

Read more about mental health and debt on our site:

- The Hidden Costs of Debt: How it Affects Your Physical Health

- The Invisible Cost of Debt: How it Affects Your Emotional Health

- How Seeking Help for Debt-Related Stress Can Boost Your Cognitive Function

- Debt and Mental Health: Why Men Need to Pay Attention

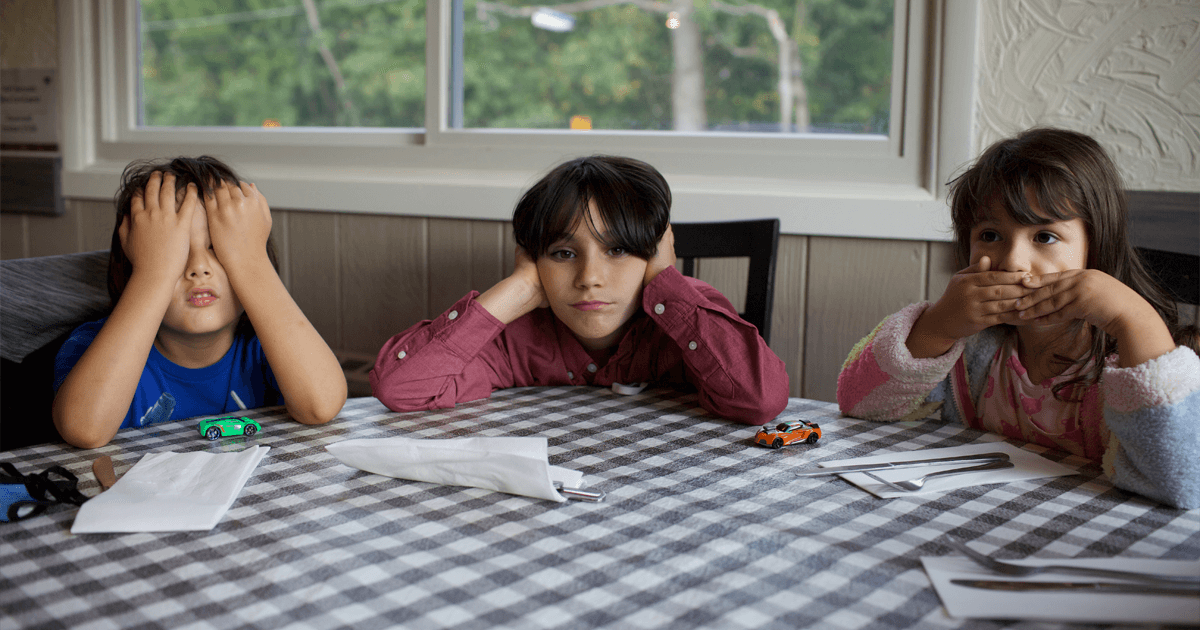

- The Cost of Debt: How Children Pay the Price

- Women and Debt: The Mental Health Toll

- From Addiction to Recovery: How Debt Can Hold You Back and CreditLift Can Help